85% Probability the S&P 500 Drops Less Than -1.2% This Week

August 24, 2017"Unless you can watch your stock holding decline by 50% without becoming panic stricken, you should not be in the stock market"

-Warren Buffet

Chinese markets are in free fall, oil prices are plummeting and many emerging markets are now teetering on the edge of bankruptcy. Yet, there is 85% probability the S&P 500 drops less than -1.2% by this Friday’s close.

This is a bold statement, since as of this writing (around 9 AM) S&P 500 Futures are down another 4% on top of the already 5% drop we saw over the last two trading sessions last week. However, this is not a prediction. This is just statistics and a gauge for the most likely outcomes this week for the S&P based on the markets reaction to similar trading environments throughout history.

THERE IS NO PRECENDENT for a drop of more than -3.6% over the next 5 days

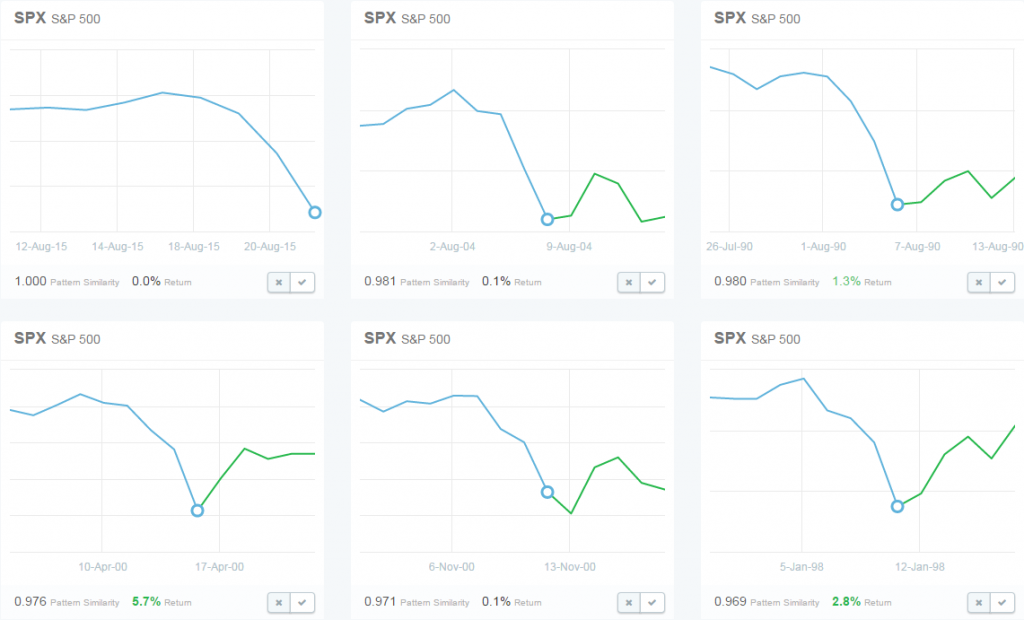

We looked at the last 10 days trading pattern in the S&P 500, and found about 100 statistically similar 10 day patterns in close to 40 years of the Indices history. Here’s a visual on the 5 most similar matches, with dates on the bottom and what happened in the next 5 days in green:

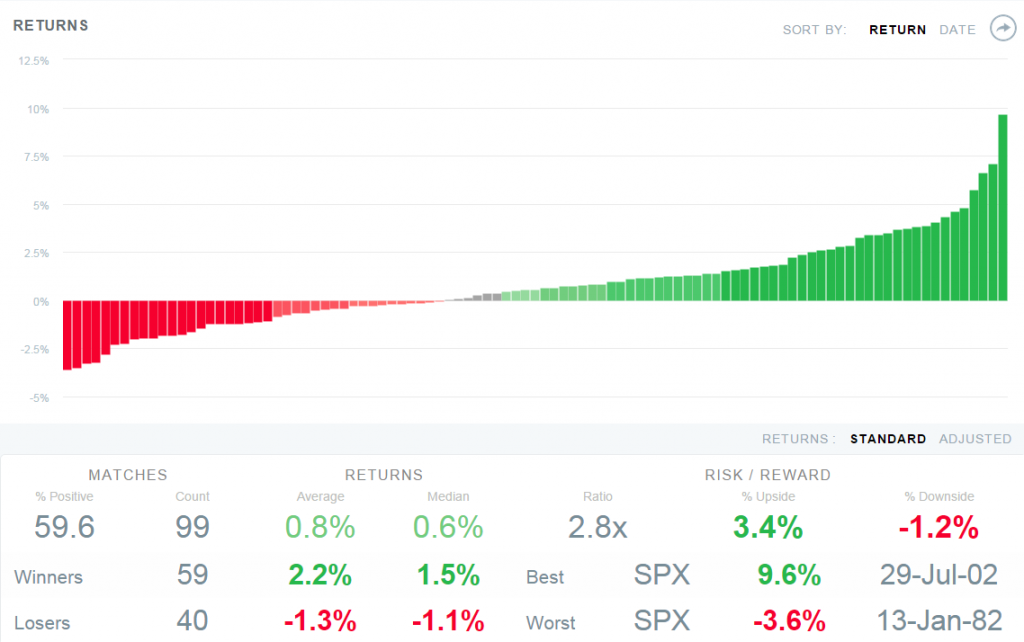

Plotted below are the next 5 days returns for all 99 highly similar matches we found for the current 10 day pattern in the S&P 500 as of Friday’s close. The worst result is a -3.6% drop in the next 5 days, and only 5 of the 99 are off more than -2.3%:

The stats table above shows an Upside and Downside band between 3.4% and -1.2%. We’ve done millions of predictions on these types of projections, and there’s 85% probability the S&P 500 will be above a -1.2% drop by Friday’s close.

Have a great week!