Good Time to Go Defensive vs. Cyclical?

By EidoSearch"I think you’re the greatest, but my Dad says you don’t work hard enough on defense."

-Quote from Joey (young kid) to Kareem Abdul-Jabbar, Airplane, 1980

The Consumer sectors continue to perform well. Over the past 6 months, tracking Morningstar Sector Indices, Cyclical and Defensive stocks are the 3rd and 4th best performing sectors, trailing only Real Estate and Healthcare (see table below).

When comparing the two, Cyclical stocks have outperformed Defensive stocks by about 5.2% over this period of time which is not surprising. The Consumer continues to have improved purchasing power with lower gas prices, more hiring and basically a flat C.P.I. Although spending growth may not be exceeding expectations so far this year, the personal savings rate has increased (first things first) and the weather in the Northeast is finally turning the corner.

Cyclicals seem set to continue to overpower Defensive stocks. Except, we’re seeing increasing volatility once again and with a rising rate environment on the horizon, investors are likely to have an itchy trigger finger for moving money out of higher beta stocks. The question is when does this play out?

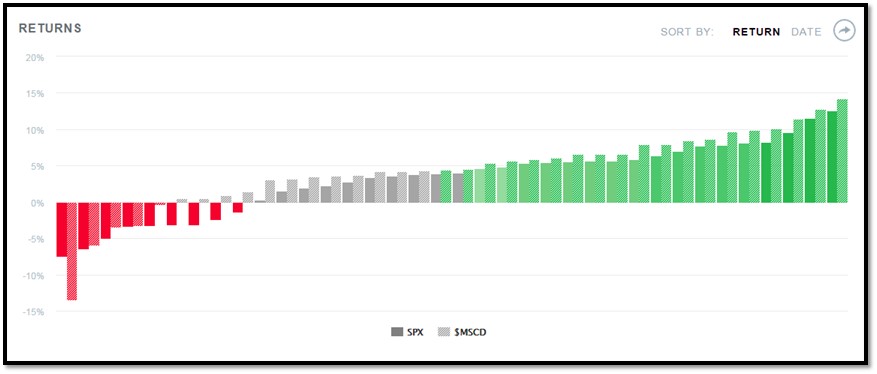

EidoSearch ran some historical analysis on both sectors. We took the 6 month price trends of the S&P 500 and each sector, to find times historically where both the sector and the market traded in a similar fashion and to see how they typically perform in the next 3 months. We found 36 analogs for both, and the results in the next 3 months historically are in the table below:

The only instance where Defensive Stocks are down more than 1% in the next 3 months is from the summer of 1998 (see historical return distributions below).

Have a great week.