A Short Term Trade Idea for Monsanto (MON)

June 8, 2015"Baseball is 90% mental, the other half is physical"

-Yogi Berra

Monsanto (MON) is down 6% over the past three weeks, while the S&P 500 is only down about 1.5% over the same period. For a stock that trades with high correlation to the market, that’s a distinct move.

For our weekly market calls, we typically provide fundamental or news based context around our statistics. This morning, we’re going to let the percentages do the talking and let investors put them into the proper context.

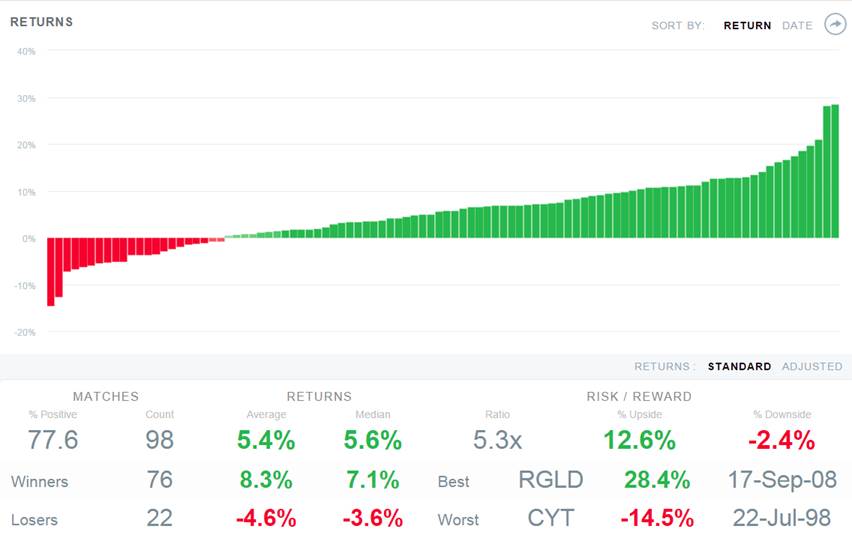

The 1 week projection below, using the current 1 month price trend for Monsanto to find the most similar instances in history in itself or peers, shows an average return of 5.4% with more than 5x the upside to downside. You can also see a dramatic positive skew vs. what the market is expecting for volatility in the next 1 week (Implied vol is in Orange)

To back up the headline statistics above, the below chart shows the 1 week forward returns of all similar instances of the current 1 month price trend for Monsanto in the peer group (Basic Material stocks). 77.6% of the time the stock rebounds in the next 1 week.

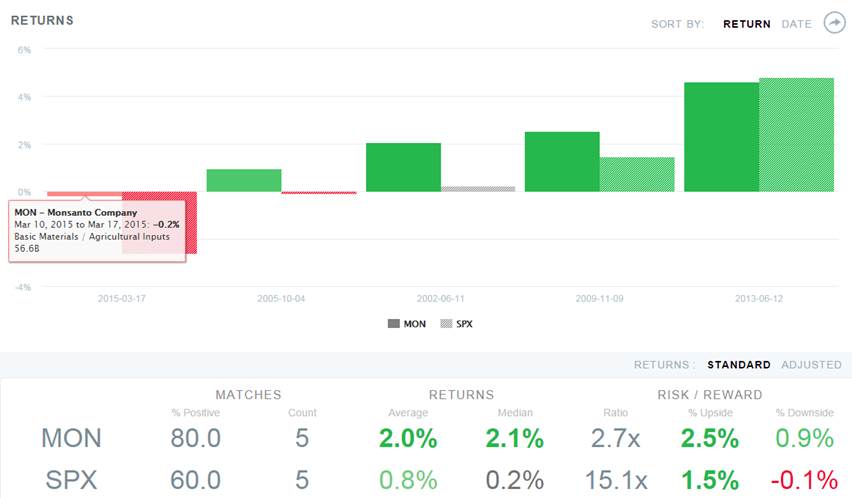

We then took the current 1 month price trend for BOTH Monsanto and the S&P 500, to find times historically where both traded with a similar trajectory and what the next 1 week outcome was. There were only 5 matches, but Monsanto was up in 4 of the 5 and basically flat in the fifth.

Have a great week!