Explanations are Not Predictions

Janauary 4, 2016"Sane people are expected to have sensible-sounding reasons for their actions."

-Philip E. Tetlock, Superforecasting

Why did Chinese shares fall by 7% today? The news is filled with explanations – weaker manufacturing data, new circuit breakers, weakening yuan – sketching a compelling story that makes it appear like we saw it coming. It’s easy to confuse the power of explanation with prediction.

Will Chinese shares fall by 7% tomorrow? Now that’s a much harder question.

At EidoSearch, we’re turning a deeply philosophical question, “what are the limits on predictability,” into a quantifiable measure. It all starts with measurable predictions that have explicit probabilities and time frames.

Let’s rollback time to last year (4 days ago!), and ask the question “Where is the S&P headed in the next 5 days?”

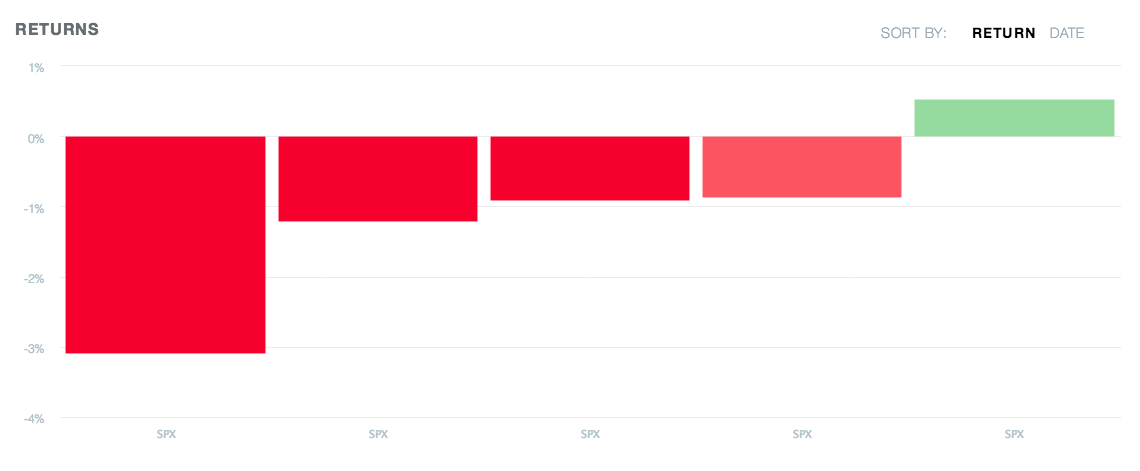

Based on five periods in history with similar conditions in the S&P, EidoSearch projected a -1.1 decline from the December 31st close in the next 5 business days. The bar chart below presents the full range of outcomes that we projected, based on the returns following each of the five matches. Using the information from these historical conditions, we can think probabilistically. For example, there was a 4 out 5 chance (80% probability) that the S&P would have declined in the next five days, and we had a 20% chance the S&P would decline by 3% or more. These conditional returns provide a framework to reason about the future.

Using the information from these historical conditions, we can think probabilistically. For example, there was a 4 out 5 chance (80% probability) that the S&P would have declined in the next five days, and we had a 20% chance the S&P would decline by 3% or more. These conditional returns provide a framework to reason about the future.

Our goal is to add rigor to the domain of forecasting. At the close today, we’ll run through our analysis and have a new set of projections by tomorrow. Please reach out if you’re interested in learning more.

Oh, and Happy New Year!