Likelihood of Another Big Pull Back for the S&P?

October 26, 2015"May the odds be ever in your favor. "

-Hunger Games, 2012

After the S&P 500 dropped 11% over six days back in the middle of August, consensus was building for a continued drop to more reasonable valuations. At a minimum, expectations were being set for minimal gains from equities for the foreseeable future. The Global economy was struggling, commodities were leading the earnings per share slowdown and it seemed all but certain we would see the first rate hike in September. This was the pull back that we had all been anticipating.

Now, here we are two months later, and the market has just about reclaimed all of that 11%. Companies have been beating lowered earnings expectations pretty handily thus far, commodity prices seem to be bottoming and there’s talk of further stimulus from China and Europe. And, the cherry on top, the Fed has once again punted on the rate hike. Is it time to start getting fearful again?

EidoSearch analyzed the unique, last 3 months trading in the S&P 500 to locate times historically where the market traded in a similar fashion and to get a gauge on how the market is likely to react today.

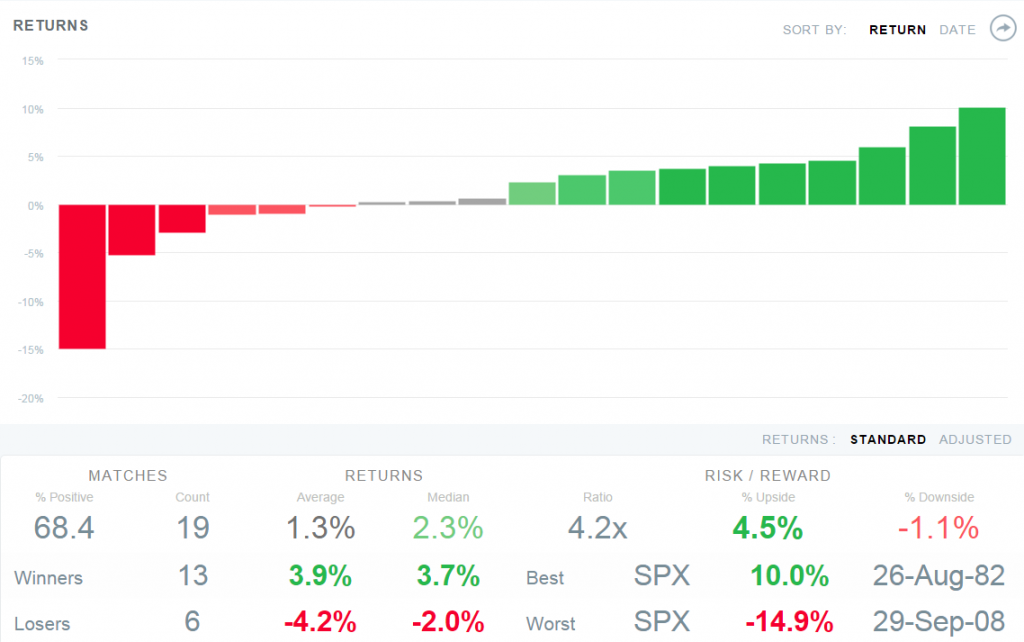

The chart below shows the current 3 month price trend in the S&P 500, along with the 1 month forward projection. We found 19 similar matches in history going back about 35 years. Although the average return in the next 1 month is not all that interesting, the range of outcomes is, with 4x the upside to downside.

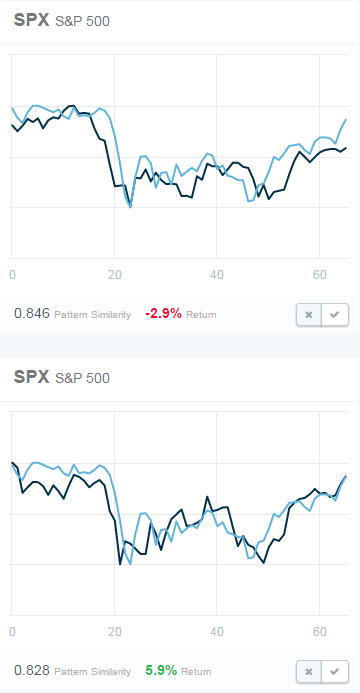

The chart below shows two of the most similar matches, from 1994 and 1998, and what happened in the next 1 month in each of those instances. The chart to the right with the two lines shows the same historical matches (in BLACK), but includes the current 3 month pattern in the SPX for visual comparison (in BLUE).

Out of the 19 historical matches, only one match is down more than -5% in the next 1 month. You guessed it, 2008. The SPX is up 68.4% of the time, and it is flat or up more than 85% of the time historically.

Have a great week!