Mexico Heating Up

By EidoSearch"Rosita: I was thinking later, you could kiss me on the veranda. Dusty Bottoms: Lips would be fine."

-Chevy Chase, The Three Amigos

After a 17% run up in 2012, the Mexican stock market (BMV IPC) has followed that up with a couple of clunkers: a drop of -1.7% in 2013 and -1.4% last year. The Index is up 7% thus far in 2015, but investors have every reason to be skeptical. The BMV IPC was up close to 9% through September of last year when it gave back all those gains and then some so here we are again.

The big difference for a sustained run this year might be thanks to a lower Peso. Mexico’s currency reached its lowest level in 20 years earlier this year, and again two weeks ago, and is down 15% from a year ago. Translation? Cheaper exports to the U.S. and Canada.

Other reasons for optimism:

– GDP forecasts at 2.5 – 3.5% percent this year vs. 2.1% last year

– Oil prices have rebounded off their lows which should help Mexico’s push for Energy Exploration

– Mexico is 23% cheaper than the U.S. stock market using CAPE (Shiller’s PE ratio)

EidoSearch ran two quick studies. The first, looking for similar analogs to the stock markets trajectory this year to get a gauge for what the next quarter might look like. Second, looking for times where both the current stock market AND the trend in the Peso were similar historically and to see what happened in the next 3 months.

Study #1

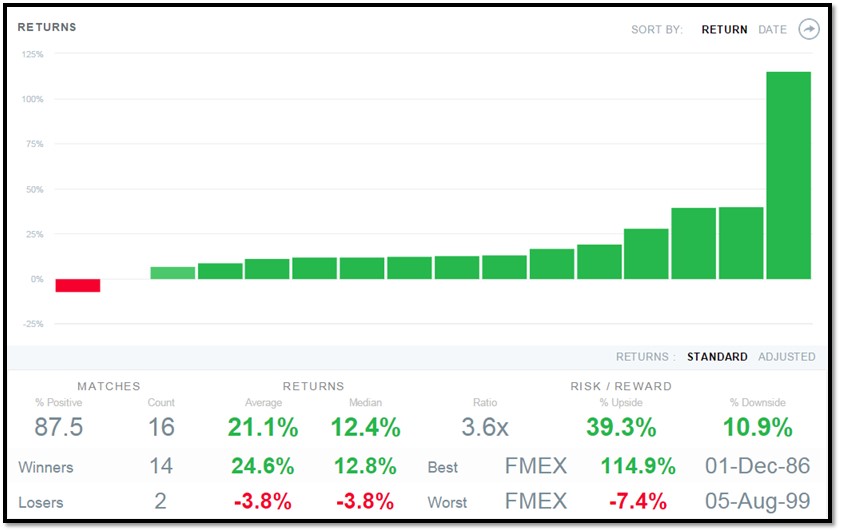

We found 16 similar instances of the current 6 month price trend in the BMV IPC (broad market index) going back 30 years, and the Index is up 87.5% of the time in the next 3 months with an average increase of 21.1%.

The following table shows the 3 month forward returns of all 16 instances and the stats for the full historical return distribution.

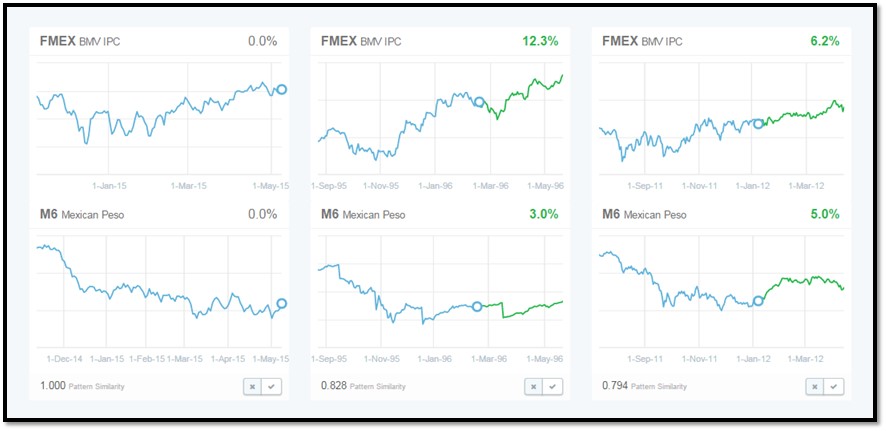

We found only two similar historical instances where both the BMV IPC AND the Peso were trading in a similar way over a 6 month period of time: 1995 and 2011, where the Index is up 12.3% and 6.2% respectively in the next 3 months.

The table below shows the analogs and mathematical similarity.