The ABC’s of Forecasting

February 22, 2016"Weather forecast for tonight: dark. "

-- George Carlin

Warning, this post may insult your intelligence. A forecast has 3 essential components:

A. Time horizon

B. Range of outcomes

C. Probability that an outcome will fall within the range

A lot of statements sound like forecasts because they use the future tense. But they are not meaningful statements unless you explicitly hear A, B and C. The silence can be deafening.

Below is our bird’s eye view of the markets for the S&P, 10 Year T-Note, Crude and Gold. This bird is looking ahead by 1 month using conditional distributions from similar periods in history.

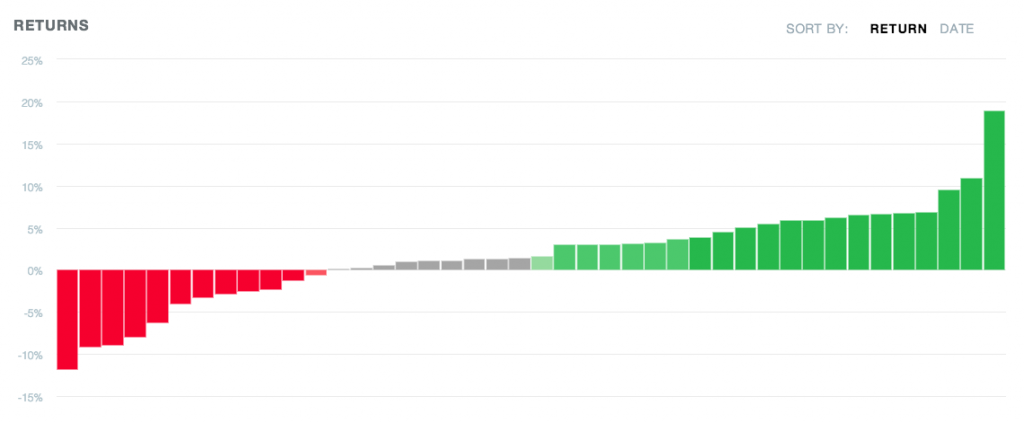

S&P

A. 1 Month from today

B. Average return of 1.7%, within a range of 6.6% to -2.8%

C. 70% historical probability of falling within the range

S&P: Full distribution of returns

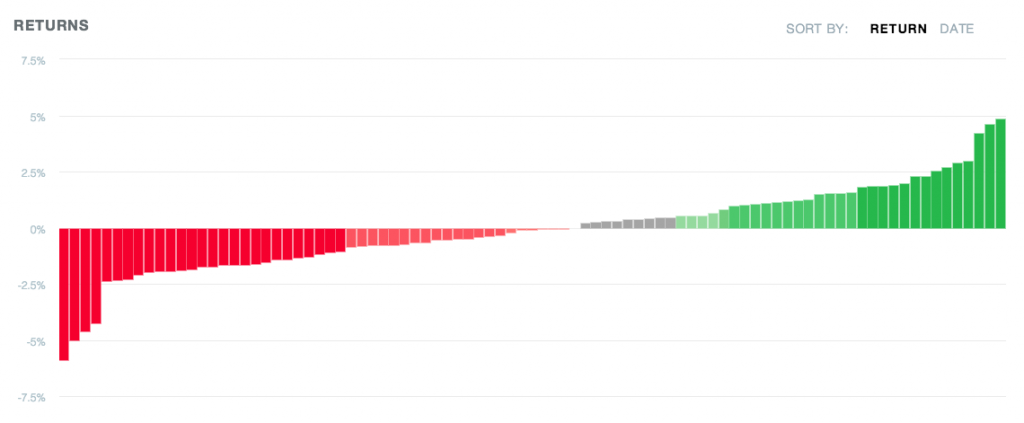

10-Year T-Note

10-Year T-Note

A. 1 Month from today

B. Average return of -0.1%, within a range of 1.6% to -1.7%

C. 70% historical probability of falling within the range

10-Year T-Note: Full distribution of returns

10-Year T-Note: Full distribution of returns

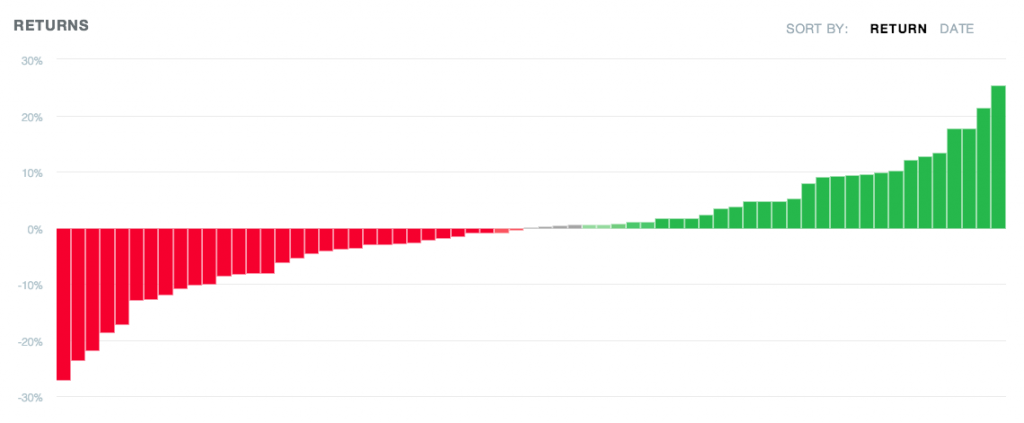

Crude Oil

Crude Oil

A. 1 Month from today

B. Average return of -0.5%, within a range of 9.2% to -10.0%

C. 70% historical probability of falling within the range

Crude Oil: Full distribution of returns

Crude Oil: Full distribution of returns

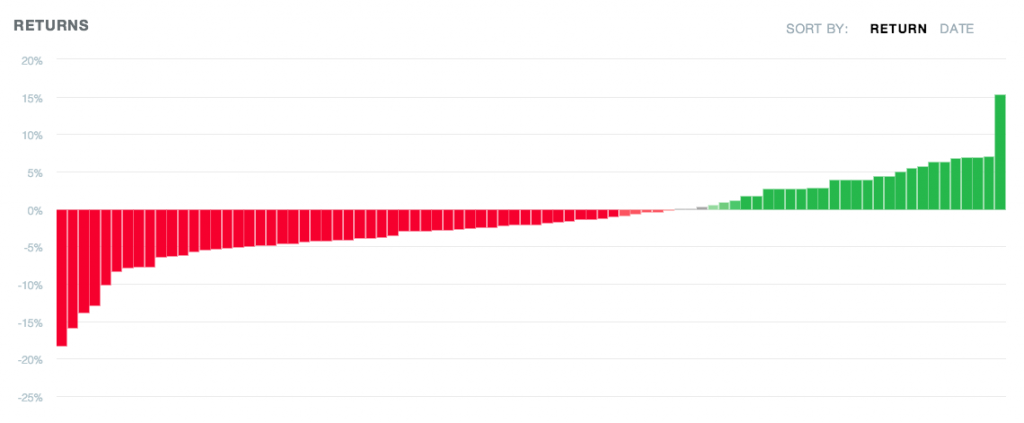

Gold

Gold

A. 1 Month from today

B. Average return of -1.6%, within a range of 3.9% to -5.2%

C. 70% historical probability of falling within the range

Gold: Full distribution of returns

Gold: Full distribution of returns

One way to accelerate and improve your forecasting ability is to have the right process in place, which often means going back to the basics. Pick your most meaningful position, and try filling in the blanks:

One way to accelerate and improve your forecasting ability is to have the right process in place, which often means going back to the basics. Pick your most meaningful position, and try filling in the blanks:

A. ___

B. ___

C. ___

If you cannot answer these 3 questions, don’t tell anyone. Send us an email and we’ll give you our best estimates. And then you can take it from there. Everyone will be better off.

Have a great week.