Yahoo! (YHOO) Rebound Short Lived

October 5, 2015"Auburn is a pretty good school. To graduate from there I suppose you really need to work hard. 20 pts and 10 rebounds will get you through also."

-Charles Barkley, NBA Hall of Fame

In mid-November of last year, Yahoo! Inc shares went above $50 for the first time in 14 years (dot com), and were up from just $15 a share when Marissa Mayer took over as CEO in July 2012. Jump on the wagon!

Not so fast. Shares have been in a steady decline since, bottoming last Monday at $27.60. Yahoo! then announced that, screw it, they were spinning off Alibaba regardless of tax consequences and the stock jumped 11% last week. Sustainable?

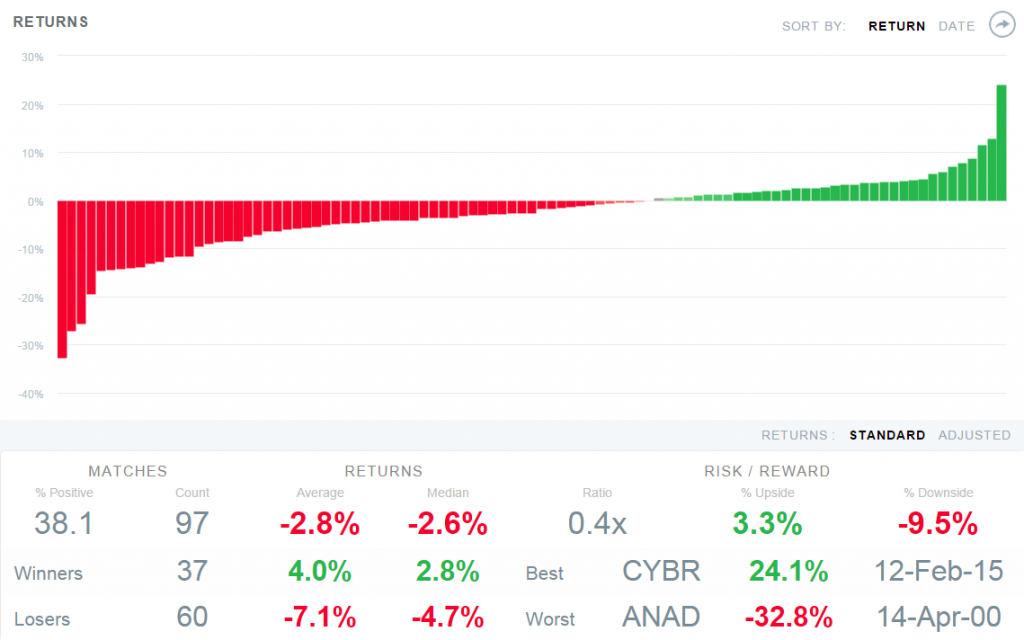

Patterns of peer companies are down -2.8% in the next week

The way the market reacts to news and events is quantifiable, at least via EidoSearch. We used our numerical search engine to find the most mathematically similar instances of their current one month price trend in Tech stocks and found 97 matches. The average return in the next one week is -2.8% with almost 3x the downside to upside.

Stocks with similar patterns historically are down 62% of the time

Stocks with similar patterns historically are down 62% of the time

Not only do we capture the typical outcome, but more important for fundamental investors is the range of outcomes. For example, if you think the Alibaba news is only going to provide a short term boost, and there’s no catalyst for a rally, then you can see how similar stocks have reacted in a renewed decline. At the extreme, there are 14 instances out of 97 that are down in the next one week more than 10%, vs. only 3 that are up over 10%.

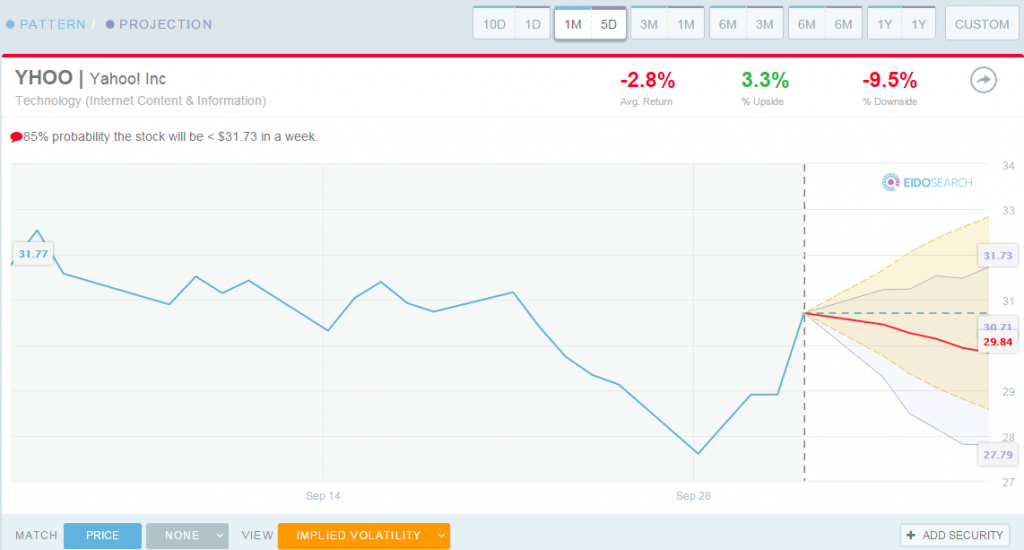

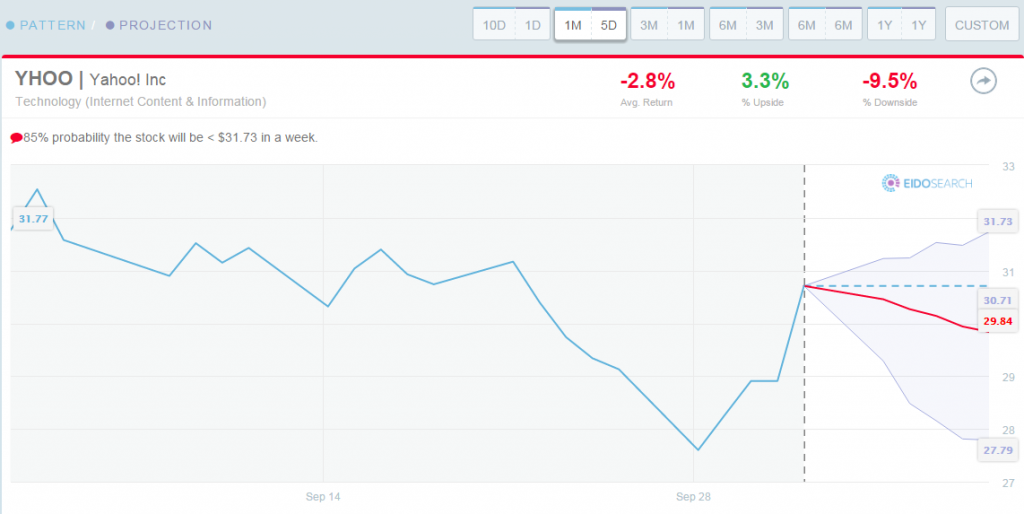

Here are the two most similar matches, and how the markets reacted to declining price, and then a quick short term rebound:

If you look at the full set of analytics for the 97 historical matches, you’ll see that a Technology stock trading in a similar way historically is up only 38.1% of the time.

There’s 85% probability the stock will be below $31.73 a share in 1 week. This is compared to the options market which is underappreciating the downside volatility one week out per the orange overlay below.

Finally, if you want to know if the statistics change much if you only focus on Internet stocks as the peer group, well we checked that too. The typical outcome is a drop of -2.2% vs. -2.8% looking at all Tech stocks historically.

Have a great week!